Get In Touch Today

We’re Here To Help

We’re Here To Help

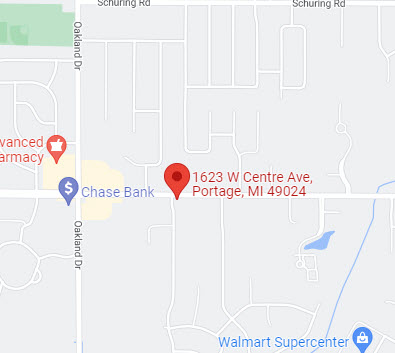

Whether you’re looking for a life insurance policy or want to learn more about fixed annuities, you won’t regret choosing Phillip R. David & Associates in Portage for help. Get a quote on your insurance coverage now by calling 269-327-1622. You may also fill out the following form to send us a message or request more information about our services.

Send Us A Message

We are specialists in Commercial, Business and Personal Insurance. Our work inspires. We pride ourselves on delivering outstanding quality and design for leading clients across the world.

We are specialists in Commercial, Business and Personal Insurance. Our work inspires. We pride ourselves on delivering outstanding quality and design for leading clients across the world.